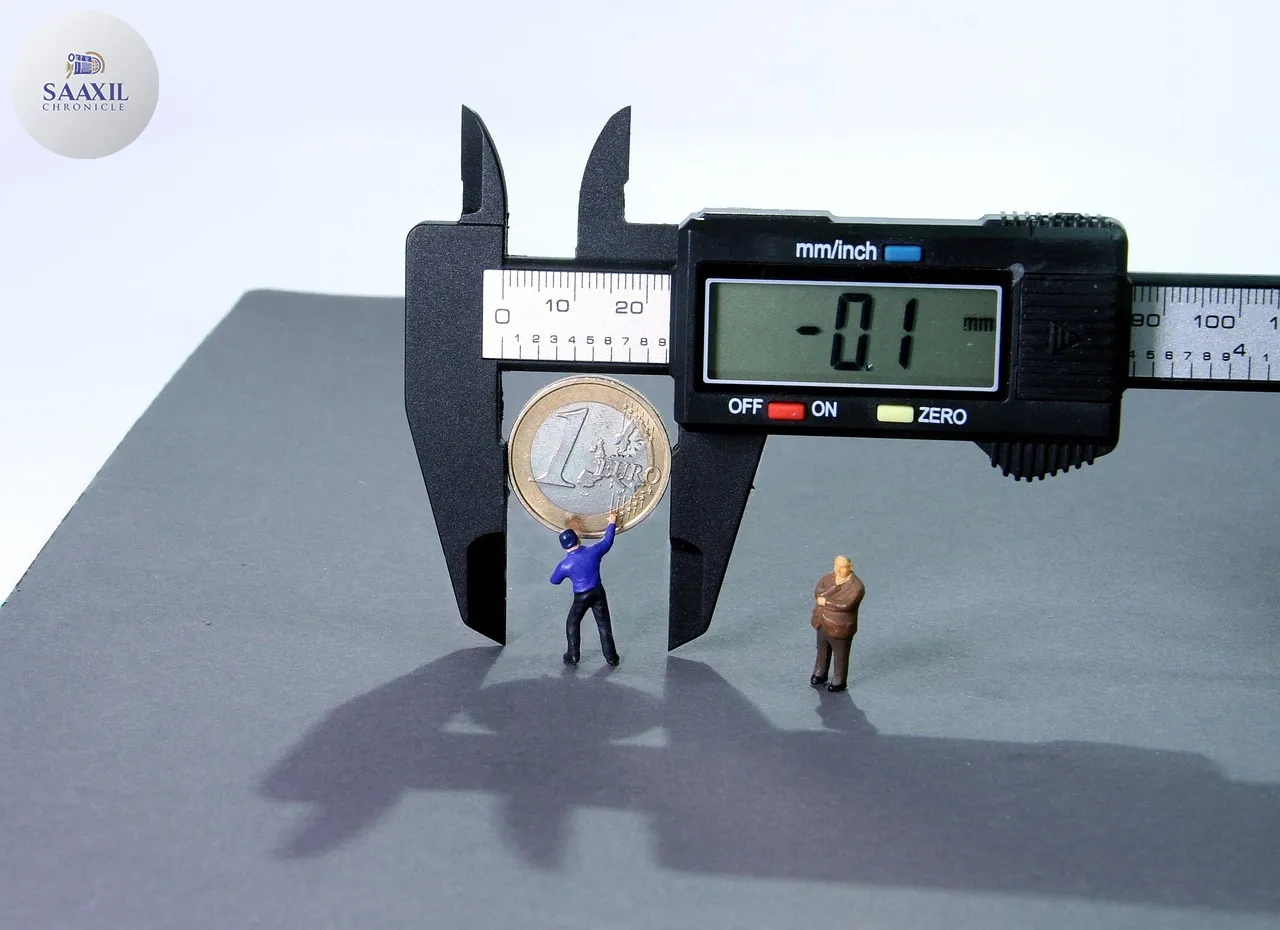

Savers across the UK are potentially missing out on billions of pounds by keeping their money in low-interest Cash ISAs, according to recent research by Paragon Bank. The study reveals that approximately £54 billion is currently held in Cash ISAs offering an interest rate of two per cent or less. Despite their popularity as a low-risk investment option, these accounts are yielding minimal returns, prompting financial experts to urge savers to explore more lucrative alternatives.

Billions Locked in Low-Interest Accounts

The research highlights a significant issue for millions of UK savers: their preference for the perceived safety of Cash ISAs is costing them dearly in unrealised potential gains. Cash ISAs are attractive due to their tax-free interest; however, with inflation rates often surpassing the interest offered, the real value of these savings diminishes over time. Paragon Bank’s findings indicate that a large portion of the market is settled with returns that barely keep up with inflation, if at all.

Cash ISAs have traditionally been a go-to for cautious savers, especially those nearing retirement, who prioritise capital preservation over aggressive growth. Yet, with interest rates remaining historically low, the opportunity cost of sticking with these accounts has never been higher. Experts suggest that savers need to weigh the benefits of tax-free earnings against the potential for higher returns elsewhere.

Timing and Location of the Report

The findings from Paragon Bank were published on 25 March 2025, shedding light on a nationwide financial habit that could be reshaping the savings landscape. The report comes at a time when the Bank of England’s interest rate policies have kept returns on savings accounts at a minimum, prompting financial analysts to call for a reassessment of traditional saving strategies.

The timing is crucial as it coincides with the end of the tax year, a period when many savers review their financial plans. The report encourages individuals to reassess their saving strategies, considering options that might offer better returns in the current economic climate.

Experts Urge Diversification

Financial experts are urging savers to consider diversifying their savings portfolios. According to Sarah Coles, a financial analyst, “Savers need to be aware that sticking solely to Cash ISAs could mean missing out on significant growth opportunities. It’s crucial to look at other investment vehicles that align with one’s risk tolerance and financial goals.”

Diversification can include a mix of stocks, bonds, and other financial instruments that historically offer higher returns than traditional savings accounts. While these options come with varying levels of risk, they also provide the potential for greater financial growth over the long term. Financial advisers recommend a balanced approach, tailored to individual financial situations and objectives.

The Appeal of Cash ISAs

Despite the potential for greater returns elsewhere, Cash ISAs remain popular due to their simplicity and security. For many, the peace of mind that comes with knowing their savings are not subject to market volatility outweighs the potential for higher earnings. Furthermore, the tax-free status of Cash ISAs is a significant draw, especially for those in higher tax brackets.

However, the current economic environment is prompting a reevaluation of this strategy. As inflation continues to erode purchasing power, the realisation that capital safety could come at the expense of growth is becoming more apparent. This realisation is driving more savers to seek advice on how to optimise their savings strategies effectively.

Potential Impacts on the Financial Market

The growing awareness of the limitations of low-interest Cash ISAs could lead to a shift in the financial market. As more savers explore alternative investment options, there could be increased demand for products that offer higher returns, such as stocks, mutual funds, and real estate investments. This shift could also spur financial institutions to innovate and offer more competitive savings products to retain customers.

Financial planners predict that this trend could encourage more individuals to engage with financial advisory services, seeking tailored advice to maximise their savings potential. This increased demand for financial literacy and planning could lead to a more informed and financially savvy population, better equipped to navigate the complexities of the financial market.

In summary, while Cash ISAs offer a safe and tax-efficient saving option, the current low-interest environment presents a compelling case for savers to explore more profitable alternatives. By reassessing their financial strategies and considering diversification, savers can better position themselves to achieve their financial goals in an ever-evolving economic landscape.